As you ride your motorcycle, you're wondering if SR22 is required, and yes, you'll need it, checking motorcycle insurance and SR22 requirements is essential for your safety on the road.

As you ride your motorcycle, you're wondering if SR22 is required, and yes, you'll need it, checking motorcycle insurance and SR22 requirements is essential for your safety on the road. (SR22 insurance filing in Tennesse

Your insurance portfolio's flexibility and cost depend on the provider you choose, so it's crucial you shop around for the best SR22 insurance options in Tennessee. You'll want to investigate various insurance provider options to find the one that suits your needs. Researching and comparing different providers will help you make an informed decision (SR22 insurance filing in Tennessee). Look for providers that offer SR22 insurance and have a good reputation for customer servi

Research multiple insurance providers for SR22.

Evaluate policy limits and deductibles carefully.

Check for discounts like bundling or defensive driving.

Compare rates from various insurers regularly. Adjust policy limits to avoid overpayment monthl

When evaluating insurance providers, you should prioritize those that specialize in high-risk insurance, as they often provide more competitive rates -

SR22 Insurance Providers TN.

SR22 Insurance Agency Tennessee. You can also check for discounts, such as bundling policies or taking defensive driving courses. By comparing quotes from various providers, you can identify the most affordable option for your situation. Remember to carefully review each quote, ensuring it includes all necessary coverage and meets Tennessee's SR22 requirements. This will help you secure affordable coverage without compromising your safety or financial stabili

You're facing a roadblock, but non-owner policies can be a lifeline, offering rental coverage, allowing you to get SR22 insurance even without a car, ensuring you're protected. - SR22 Insurance Agency Tenness

You can't cancel SR22 insurance early without repercussions, as early termination may lead to SR22 cancellation, affecting your driving privileges and requiring renewed coverage to reinstate them immediatel

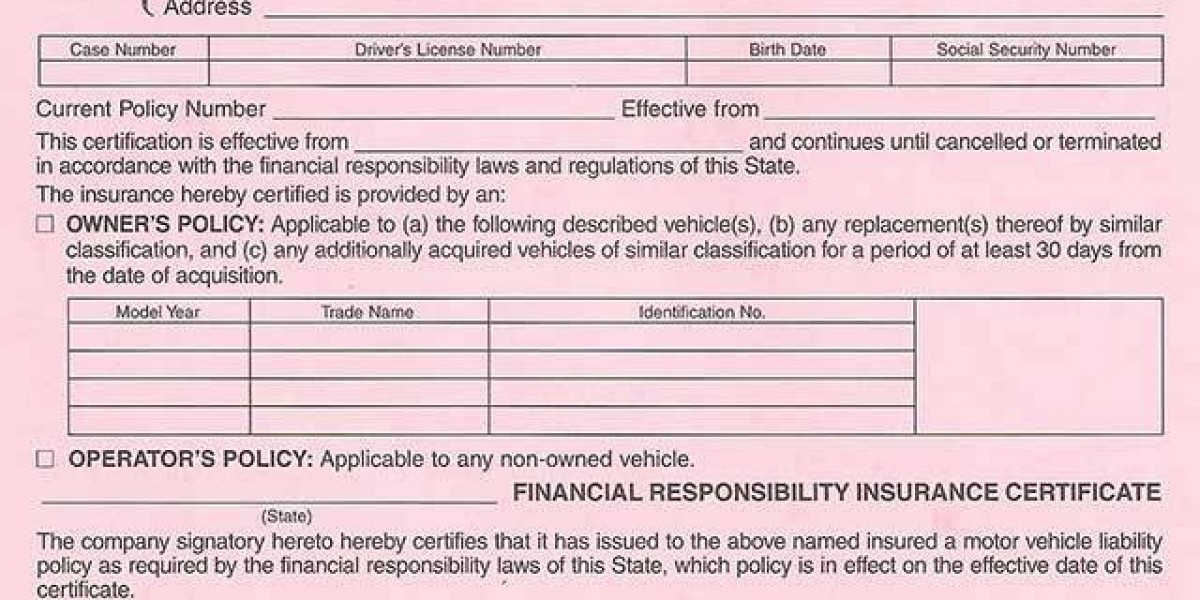

Tennessee's state laws typically require you to file an SR22 form with the Department of Motor Vehicles (DMV) if you've been convicted of certain offenses, such as driving under the influence (DUI) or reckless driving - driving with a suspended license. You'll need to comply with Tennessee penalties, which can include fines, license suspension, and mandatory insurance coverage.

You should understand the insurance regulations in Tennessee, as they can impact your ability to drive. Some key concerns includ

As you're reviewing SR22 requirements, you'll find it coincides with your state's laws, and you're wondering if it's transferable, affecting SR22 costs, and ultimately, your safety and financial security. (driving with a suspended licens

Comparing quotes from different insurers is also essential in finding cheap rates. You'll want to research and evaluate various insurance providers to determine which ones offer the most competitive prices for SR22 insurance in Tennessee. By comparing quotes and finding discounts, you can save money on your premiums without compromising on the level of coverage you need. insurance carriers. This approach will help you make an informed decision and secure the best possible rate for your SR22 insurance in Tennessee, ensuring you stay safe and compliant on the ro

n Bodily Injury Liability

$25,000/$50,000

Property Damage Liability $15,000

Uninsured Motorist Bodily Injury

$25,000/$50,000

Uninsured Motorist Property Damage

$15,0

You're considering SR22 cancellation, but you must complete the SR22 renewal timeline, typically 3 years, before initiating the SR22 cancellation process, ensuring compliance and avoiding penalties. - SR22 insurance filing in Tenness

You should know that the SR22 duration in Tennessee typically ranges from 3 to 5 years, depending on the offense. During this time, you're required to maintain continuous insurance coverage. If you cancel or lapse your policy, your insurer will notify the DMV, and you may face additional Tennessee penalties, including license revocation. It's imperative that you understand these requirements to avoid further complications and guarantee your safety on the road. By filing the SR22 form and maintaining the required insurance coverage, you can fulfill the SR22 duration and get back to driving safel

Because you're likely looking for cheap

SR22 insurance TN insurance in Tennessee, it's vital to understand what SR22 requirements entail. You'll need to file SR22 forms - SR22 insurance filing in Tennessee with the state, which verifies that you have the necessary insurance coverage. This requirement is usually mandatory after a driving offense, such as a DUI or reckless driving. You must comply with state regulations, which dictate the minimum liability insurance you need to car

You're checking if SR22 coverage includes other drivers, it typically doesn't, as

SR22 insurance TN requirements are linked to your license, not others who drive your vehicle, affecting your premiums accordingly. %anchor_text

Unlocking the Secrets of Trusted Online Lottery Sites: A Guide to Situs Togel Terpercaya

Par pecel0437

Unlocking the Secrets of Trusted Online Lottery Sites: A Guide to Situs Togel Terpercaya

Par pecel0437Donghaeng Lottery Powerball: Insights from the Bepick Analysis Community

Par shelliedubay46 BRO138 Slot Demo Gratis: Coba Dulu Sebelum Main Uang Asli

Par stephengraver

BRO138 Slot Demo Gratis: Coba Dulu Sebelum Main Uang Asli

Par stephengraver Saúde do Seu Gato: Entenda Tudo Sobre o PRÉ 4 FELINO e Garanta o Bem-Estar do Seu Amigo Fiel

Saúde do Seu Gato: Entenda Tudo Sobre o PRÉ 4 FELINO e Garanta o Bem-Estar do Seu Amigo Fiel

Betting Wars: Hisbah Police Raids Intensify as Tech Company Confronts Nigeria's Gaming Leaders

Betting Wars: Hisbah Police Raids Intensify as Tech Company Confronts Nigeria's Gaming Leaders