To maximize your savings, you should compare rates from multiple insurance companies and consider factors like coverage limits and deductibles.

To maximize your savings, you should compare rates from multiple insurance companies and consider factors like coverage limits and deductibles. By doing so, you can identify the most affordable option that meets your needs - SR22 Insurance Agency Tennessee. Additionally, you may want to opt for a higher deductible to lower your premium, but make sure you can afford the out-of-pocket expenses in case of a claim. By implementing these budget strategies and securing premium discounts, you can reduce your SR22 insurance premiums and allocate the savings to other essential expenses, ultimately enhancing your financial stability and safety on the ro

Your financial protection is a top priority when it comes to SR22 insurance in Tennessee, and you'll want to investigate options that provide adequate coverage. You're looking for financial security, and SR22 insurance can help you achieve that. How to get SR22 insurance in TN. By managing risk, you can protect yourself and your assets in case of an accide

You'll want to assess these factors carefully to find the best option for your needs. By implementing these budget friendly strategies, you can reduce your SR22 insurance rates and allocate your funds more efficiently. Effective financial planning. personal automobile liability insurance policy is key to managing your insurance costs and ensuring your safety on the ro

When looking for budget-friendly tips, consider opting for a policy with a higher deductible - personal automobile liability insurance policy, as this can lower your premium. You should also take advantage of discounts offered by insurance companies, such as those for good driving records or defensive driving courses. Additionally, bundling your

SR22 insurance TN insurance with other policies can help reduce your overall insurance cost. Implementing these cost-effective strategies can help you save money on your SR22 insurance in Tennessee. By being proactive and comparing rates, you can find a policy that meets your needs and budget, ensuring you're safely back on the road without breaking the ba

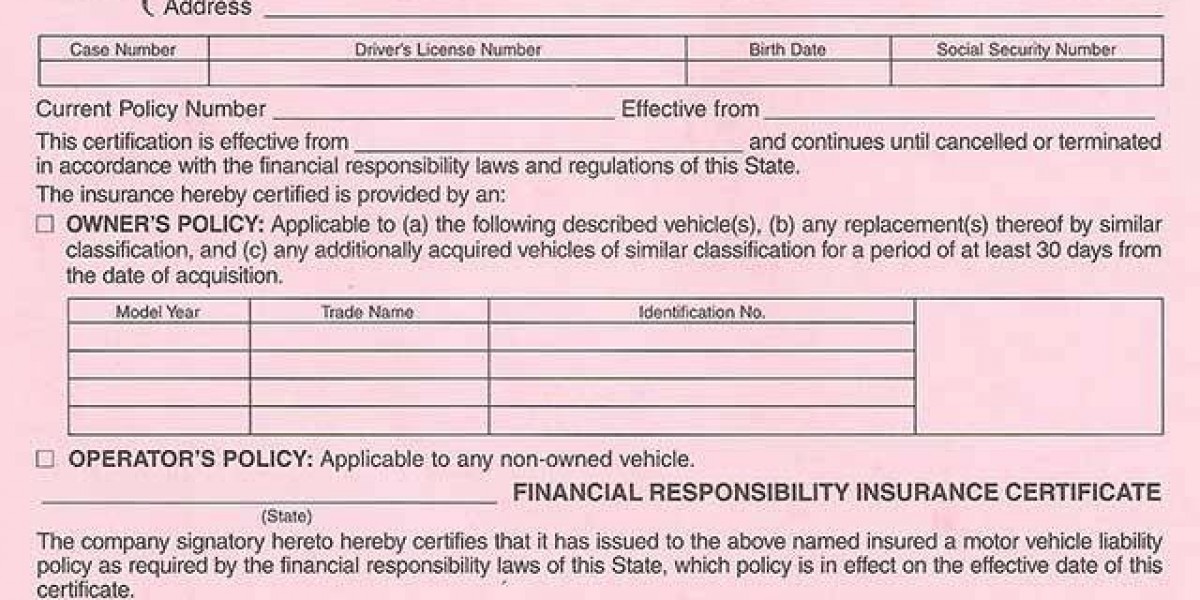

Upon conviction of certain driving offenses, Tennessee mandates SR22 insurance, which comes with specific requirements. You must purchase an SR22 policy from an authorized insurance provider and submit the required forms to the Tennessee Department of Motor Vehicles - personal automobile liability insurance policy. This guarantees you carry the minimum liability coverage, which includes bodily injury and property dama

You should verify your

SR22 insurance TN eligibility before initiating the filing process to avoid any potential issues -

SR22 insurance requirements In TN. It's important to comply with the state's regulations to maintain your driving privileges. By understanding the SR22 filing process, you can make certain of a smooth and efficient experience, getting you back on the road safely and secure

When you find a suitable quote, you can often secure instant coverage, which is vital for maintaining continuous insurance and avoiding further complications. You can typically request fast quotes online or over the phone, and providers will guide you through the process. It's important to provide accurate information to receive precise quotes (SR22 Insurance Agency Tennessee). By doing so, you'll be able to obtain fast quotes and secure instant coverage, ultimately finding the best SR22 insurance deal in Tennessee for your situati

Filing an SR22 in Tennessee requires you to submit a formal document. SR22 Insurance Agency Tennessee to the state's Department of Motor Vehicles (DMV), which certifies that you have the minimum required insurance coverage. You'll need to make sure you meet the SR22 eligibility requirements before submitting the documen

You must guarantee you have the right type and amount of coverage to protect yourself and others - SR22 Insurance Agency Tennessee on the road. By understanding the different types of SR22 insurance policies and their requirements, you can make an informed decision and get the best deal for your situati

When searching for low rates, consider factors like your driving history, vehicle type, and location. These factors can impact your insurance rates, so it's crucial to provide accurate information when requesting quotes. You can also ask about discounts, such as bundling policies or taking a defensive driving course. By doing your research and shopping around, you can find affordable SR22 insurance that provides the protection you need without exceeding your budget. This way, you can drive safely and responsibly while staying within your mean

You're required to get SR22 insurance in Tennessee if you've been convicted of certain driving offenses, such as a DUI or reckless driving. This type of insurance is a certificate of financial responsibility that proves you have the necessary insurance coverage to drive. The SR22 definition is a state-mandated requirement that guarantees you maintain liability insurance. personal automobile liability insurance policy for a specified peri

Unlocking the Secrets of Trusted Online Lottery Sites: A Guide to Situs Togel Terpercaya

Sa pamamagitan ng pecel0437

Unlocking the Secrets of Trusted Online Lottery Sites: A Guide to Situs Togel Terpercaya

Sa pamamagitan ng pecel0437Donghaeng Lottery Powerball: Insights from the Bepick Analysis Community

Sa pamamagitan ng shelliedubay46 BRO138 Slot Demo Gratis: Coba Dulu Sebelum Main Uang Asli

Sa pamamagitan ng stephengraver

BRO138 Slot Demo Gratis: Coba Dulu Sebelum Main Uang Asli

Sa pamamagitan ng stephengraver Saúde do Seu Gato: Entenda Tudo Sobre o PRÉ 4 FELINO e Garanta o Bem-Estar do Seu Amigo Fiel

Saúde do Seu Gato: Entenda Tudo Sobre o PRÉ 4 FELINO e Garanta o Bem-Estar do Seu Amigo Fiel

Betting Wars: Hisbah Police Raids Intensify as Tech Company Confronts Nigeria's Gaming Leaders

Betting Wars: Hisbah Police Raids Intensify as Tech Company Confronts Nigeria's Gaming Leaders