The rise of digital assets has led to one undeniable fact: mining remains one of the most vital parts of the crypto ecosystem. For those who want to get involved beyond buying coins, purchasing hardware is often the first step. If you’ve been searching for a mining rig for sale, you’ve likely discovered just how many choices exist—and how overwhelming the buying process can feel.

From small-scale setups to professional-grade rigs, there are endless options. But which one is right for you? More importantly, how can you avoid overpriced or unreliable machines? This guide breaks down what to look for, the pros and cons of mining rigs, and what you need to know before making a purchase in 2025.

Why Mining Rigs Still Matter

Despite the rise of proof-of-stake blockchains, proof-of-work remains crucial for coins like Bitcoin. Mining rigs keep these networks secure and decentralized, while giving miners the opportunity to earn rewards.

But profitability depends on much more than plugging in a machine. Factors like energy costs, hardware efficiency, and crypto price movements all play a role. That’s why finding the right mining rig for sale is more about strategy than luck. A rig with the wrong specs could eat into your profits, while a well-chosen setup could pay itself off over time.

What Exactly Is a Mining Rig?

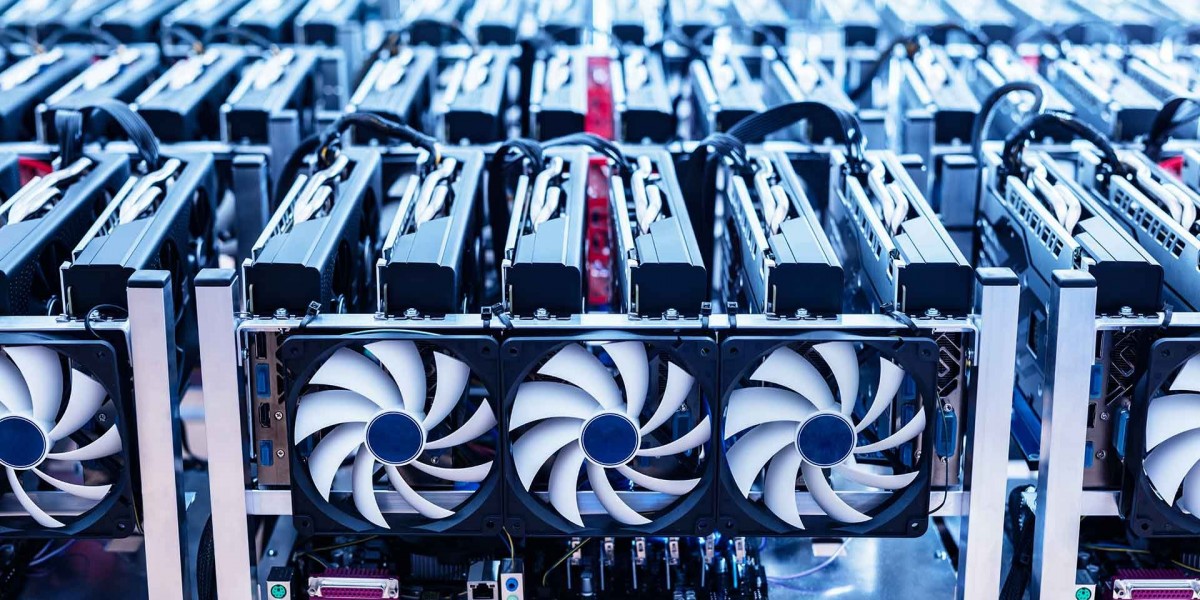

A mining rig is a computer system built specifically to process blockchain transactions. Unlike a standard computer, rigs are optimized to solve cryptographic puzzles. There are generally two main categories:

GPU Mining Rigs – These use high-powered graphics cards. They’re versatile and can mine multiple coins like Ethereum Classic or Ravencoin, but they’re less efficient for Bitcoin.

ASIC Miners – Application-Specific Integrated Circuits built for one purpose: mining. These are faster, more powerful, and dominate Bitcoin mining.

When browsing for a mining rig for sale, knowing which type fits your goals is the first big decision.

Factors to Consider Before Buying

Before you click “buy,” there are several important considerations that separate a profitable setup from an expensive mistake.

1. Hash Rate

This measures how fast a rig can solve puzzles. Higher hash rates mean more chances of earning rewards, but also higher energy consumption.

2. Energy Efficiency

A rig that guzzles electricity might produce coins but drain your wallet in utility bills. Always check the power consumption to ensure profitability.

3. Initial Cost

When looking at any mining rig for sale, balance the upfront price with potential long-term earnings. A cheap rig isn’t always the best if it underperforms.

4. Coin Choice

Not all rigs are suited for all coins. If you’re interested in mining Bitcoin, ASICs are the go-to. For altcoins, GPUs may offer more flexibility.

5. Resale Value

Hardware evolves quickly. A rig that’s valuable today may be outdated tomorrow. Look for models that retain resale potential.

Where to Find a Mining Rig for Sale

Finding trustworthy sellers is half the battle. With the crypto industry’s rapid growth, the market is flooded with both reliable suppliers and questionable resellers.

Official Retailers: Buying directly from manufacturers or authorized distributors ensures authenticity and warranty support.

Secondhand Market: Platforms like eBay or specialized forums often list used rigs. While cheaper, these come with risks—limited lifespan, hidden defects, or no warranty.

Dedicated Crypto Stores: Some websites specialize in mining hardware and often provide bundle deals, setup guides, and customer support.

If you’re linking externally, make sure your source offering a mining rig for sale is transparent about specifications, warranty, and shipping.

Risks to Keep in Mind

Like any investment, mining comes with risks.

Market Volatility: Crypto prices fluctuate. Even the best rig can lose profitability during market downturns.

Regulations: Some regions restrict or heavily tax mining operations. Always research local laws.

Hardware Lifespan: Rigs run 24/7, and components wear out. Plan for maintenance and replacement costs.

Difficulty Adjustments: As more miners join the network, earning rewards becomes harder, impacting profitability.

Being prepared for these risks can help you make smarter buying decisions.

Is Now a Good Time to Buy?

This is the question on many minds: is 2025 the right time to buy a mining rig? The answer depends on your goals.

If you’re looking for short-term profits, remember that market conditions can shift quickly.

If you believe in the long-term value of coins like Bitcoin, then securing a mining rig for sale now could be a way to accumulate coins before the next major market cycle.

Patience and careful planning are key.

Conclusion

Mining continues to be an essential part of the crypto landscape, and for enthusiasts and investors alike, finding the right mining rig for sale is the first step in joining this side of the industry.

Whether you’re aiming to mine Bitcoin with an ASIC machine or explore altcoins with a GPU rig, the decision should never be rushed. Take the time to analyze efficiency, cost, and your personal goals. Most importantly, buy from trusted sources to avoid costly mistakes.

In 2025, mining isn’t just about plugging in a machine—it’s about strategy. If done right, your rig could not only secure blockchain networks but also become a valuable source of long-term rewards.